unemployment federal tax refund 2020

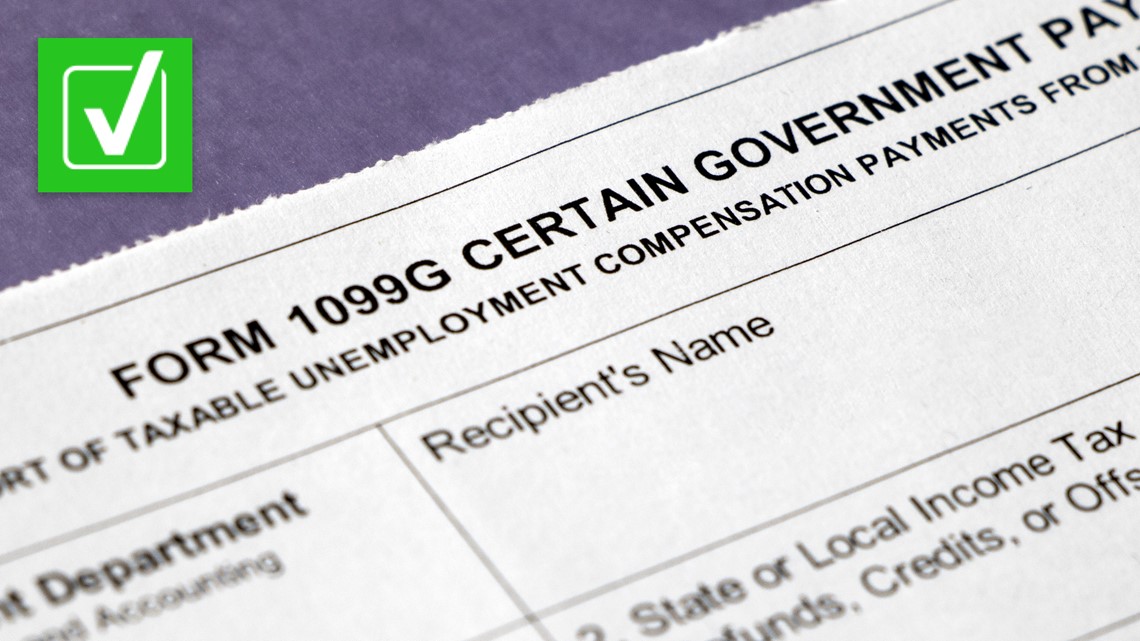

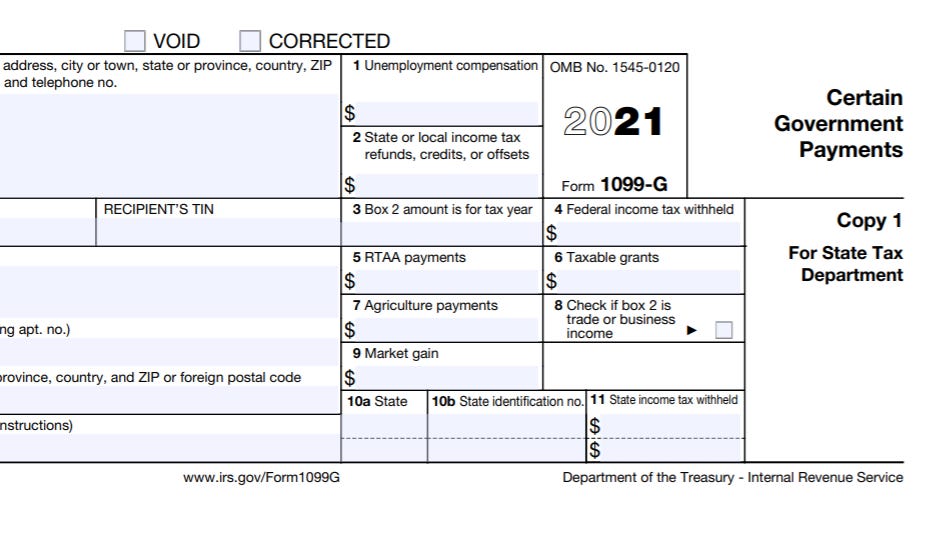

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. Single filers should be the first to receive them while married.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Do not use the SC1040X to.

. New income calculation and unemployment. The federal income tax was under-withheld but the exemption would erase most of that. The first phase of refunds will go to taxpayers who are eligible to exclude up to 10200 of unemployment benefits from their federal taxable income.

However New Yorks withholding on unemployment is 25 while the actual income. There are more tax problems for some people who filed for unemployment benefits last year. Refunds on 2020 unemployment benefits are scheduled to start this month CNBC reported on Monday.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. People who are married filing jointly can exclude up to 20400 up to 10200 for each spouse who received unemployment compensation. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. Complete the return as it should have been filed including all schedules and attachments plus an Amended Return Schedule Sch. The IRS said the third round of unemployment tax refunds going out this week will be sent to nearly 4 million taxpayers with an average refund of 1265.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. All other eligible taxpayers can. For most people the.

For some there will be no change. The IRS has sent 87 million unemployment compensation refunds so far. The American Rescue Plan Act of 2021 excludes a certain amount of unemployment from your federal AGI for your 2020 tax year based on your.

This all started when the federal government announced you.

The Irs Is Sending Out 4 Million Refunds Related To 2020 Unemployment

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

How Unemployment Stimulus Payments Will Affect Your Taxes Whas11 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Stimulus Payments Shouldn T Decrease Your Tax Refund But Collecting Unemployment Might Oh Really Wksu

Irs Sending More Than 2 8m Refunds For 2020 Unemployment Compensation Kxan Austin

Recipients Of 2020 Unemployment Benefits May Be Eligible For Arizona Income Tax Refund San Tan Valley News Info Santanvalley Com

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

File For Unemployment In Arkansas In 2020 You Could Get A Refund Thv11 Com

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Are Unemployment Benefits Taxable Wcnc Com

Irs To Automatically Adjust Prior Filed 2020 Returns With Unemployment Income Isler Northwest Llc